Sri Lanka’s Investment policy is geared towards the realization of national sustainable development goals and grounded in country’s overall development strategy. Investment policy priorities are based on a thorough analysis of the country’s comparative advantages and development challenges and opportunities.

Its strategic priorities include:

Available Investment Opportunities through the Board of Investment of Sri Lanka’s liberal regime:

- IT & IT enabled services

- Manufacturing

- Apparel

- Printed Circuit Boards

- Medical Devices

- Solar Panel Manufacturing

- Electrical and Electronics

- Auto Component.

- Logistics

- Tourism and Leisure

- Food Processing

Why to Invest in Sri Lanka?

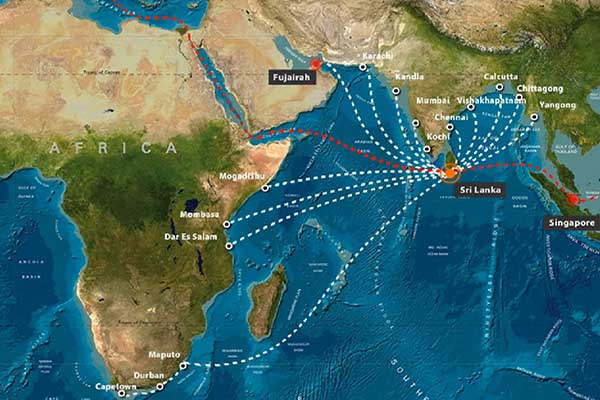

Strategic Location

Sri Lanka is situated strategically at the crossroads of major shipping routes to South Asia, the Far East and the continents of Europe and America, making the country a convenient port of call for shipping lines and airfreight services. Further, Sri Lanka’s proximity to the Indian sub-continent positions the country as a gateway to a market of 1.3 billion people. These factors have combined to generate keen interest in the country’s logistics sector, as well as from manufacturers looking for opportunities in the South Asian region.

Investment Incentives

The Inland Revenue Act No. 24 of 2017 provides an Incentive Regime granting reduced tax rates (for specific sectors) and Enhanced Capital Allowances based on capital investments made by the investors, effective from 1st April 2018.

- Reduced Tax Rates

- Enhanced Capital Allowance (ECA)

- Temporary Enhanced capital allowance

- Duty Exemptions on Importation of Project Related Capital Goods

- Duty Exemptions on Importation of Raw Materials

Access To Key Markets

Sri Lanka’s strategic location provides great opportunities to enter into free trade and partnership agreements with several of Asia’s trade powerhouses.

Free Trade Agreements

| FTA | Effective Date | Trade Access (No. of items under Zero Duty concession) | Market Access |

|---|---|---|---|

| The Indo-Lanka Free Trade Agreement (ISLFTA) | Year 2000 | 4,200 products of Sri Lankan origin | 1.3 Billion |

| The Pakistan-Sri Lanka Free Trade Agreement (PSLFTA) | Year 2005 | 4,600 products from Sri Lanka | 203 Million |

| The Free Trade Agreement (FTA) between Sri Lanka and Singapore | Year 2018 | Gives access to investments and services beyond trade in goods | 5.6 Million |

| GSP+ | Trade Access | Market Access |

|---|---|---|

| 6,200 out of 7,200 tariff lines | 511.8 Million |

These four markets alone combine to present an opportunity to reach approximately 2 billion people, when establishing your enterprise in Sri Lanka.

An added advantage for a company locating to Sri Lanka is the preferential trade access gained to two large regional blocs under the South Asian Free Trade Area (SAFTA) and the Asia-Pacific Trade Agreement (APTA).

Educated And Adaptable Workforce

Sri Lanka comprises of a highly versatile and skilled workforce which is cost competitive, highly productive and bilingual. Majority of the Sri Lankan workforce consist of highly qualified professionals having extensive experience in, numerous fields such as information technology, manufacturing, finance and accounting, fashion and design, and law.

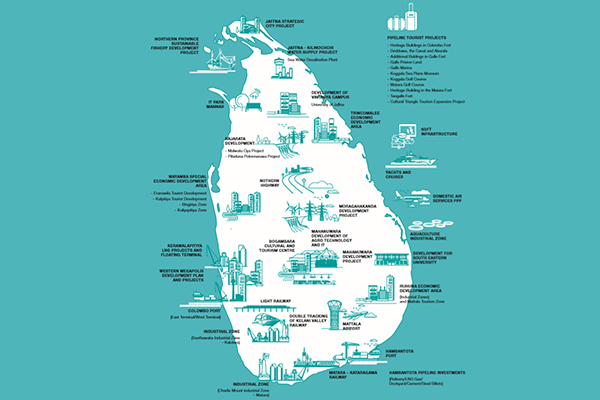

- Fast Developing Infrastructure

- Road & Rail

- Ports

- Airports

- Telecom

Quality Of Life

Sri Lanka often referred to as the ‘pearl of the Indian ocean’, is claimed by both locals and expats alike as a truly great place to live and work. A country of many facets, Sri Lanka offers a spectrum of experiences, cultures and places for those who enjoy diversity and variety. The country’s expansive beaches, rolling hills, rainforests and cosmopolitan cities make Sri Lanka an eclectic experience for all.

Investment Protection

Bilateral Investment Promotion and Protection Treaties

Sri Lanka has entered into 28(including Pakistan) Bilateral Investment Promotion and Protection Treaties (BITs) so far, providing a protection to foreign investments within the country. Sri Lanka is developing its model BIT with a view to cater to the needs of covering the aspects of sustainable development principles in attracting foreign investments.

Avoidance of Double Taxation

Sri Lanka has entered in to Double Taxation Avoidance Agreements with 44 countries (including Pakistan) to eliminate or mitigate the incidence of juridical double taxation and avoidance of fiscal evasion in the international trade (or transactions).

Other Services offered by the Board of Investment, Sri Lank

- Legal Services

- Import Export Facilitation

- Engineering Approvals

- BOI Adverts

- Environmental Clearances

- Industrial Labour Relations

For more information or assistance, please contact Consulate General of the Democratic Socialist Republic of Sri Lanka in Karachi, Pakistan, slcgkhi@yahoo.com, 021-35854024